Banks and financial institutions have some of the most demanding industry IT requirements. They need to ensure real-time availability of data for banking transactions and applications, while at the same time protecting sensitive client and proprietary information. In addition, they are subject to increasing levels of ever more stringent compliance and regulatory requirements.

As digitalisation is increasing, so is the number and complexity of cyber-attacks. The banking industry has always been a ‘hacker-favourite’. This trend continues to be true according to the latest “Cost of Cybercrime” study by Accenture:

In parallel, IBM and Ponemon’s “Cost of a Data Breach” report indicates an average total cost of a data breach of $5.86M for the financial industry (number two after healthcare).

Responses to data breaches are increasingly severe, with an average stock price decline of 6.8% (from 4.4% in 2016).

Customer decline after ID theft or fraud:

In addition, it is worth noting that consequences of a data breach have a tendency to linger long after the incident – especially in high regulatory environments – with only 53% of costs occurring in the first year, 31% in the second year and 16% more than two years after the incident.

Quantum computers are ideally suited to solve complex mathematical problems, such as the factoring of large numbers, which is at the core of asymmetric cryptosystems.

Implication for cyber security are serious: quantum computers will break most internet security solutions relying on public-key cryptography. Today’s encrypted data is already at risk as it can be stored and decrypted once quantum computers are available.

Organisations that need to protect data for 10+ years must start their quantum journey today.

The foundation of a good cybersecurity strategy relies on the quality of the entropy used to generate encryption keys.

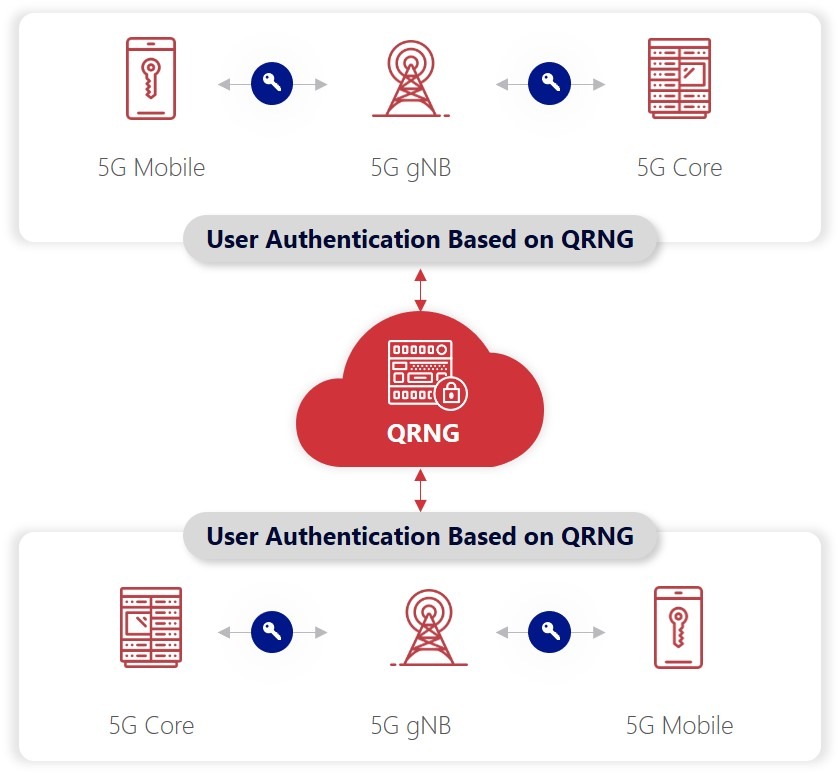

Quantum physics proves that a Quantum Random Quantum generator are truly random and can generate keys at much higher speeds than conventional number generators. The use of QRNGs is therefore an easy first step towards Quantum Safety.

IDQ provides QRNGs in various form factors and performances to respond to most use cases encountered in financial applications such as authentication, encryption, digital signatures, secure access control, high speed trading or blockchain private key generation.

QRNG can also provide distributed randomness-as-a-service through the Quantis Appliance, for use in security applications as well as in financial simulations (such as Monte Carlo simulations).

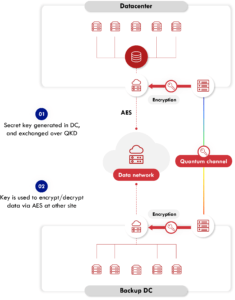

Quantum Key distribution is the logical next step towards Quantum safety. Once data is encrypted, the interception of the key that was used for the encryption would “nullify” the effect of the encryption.

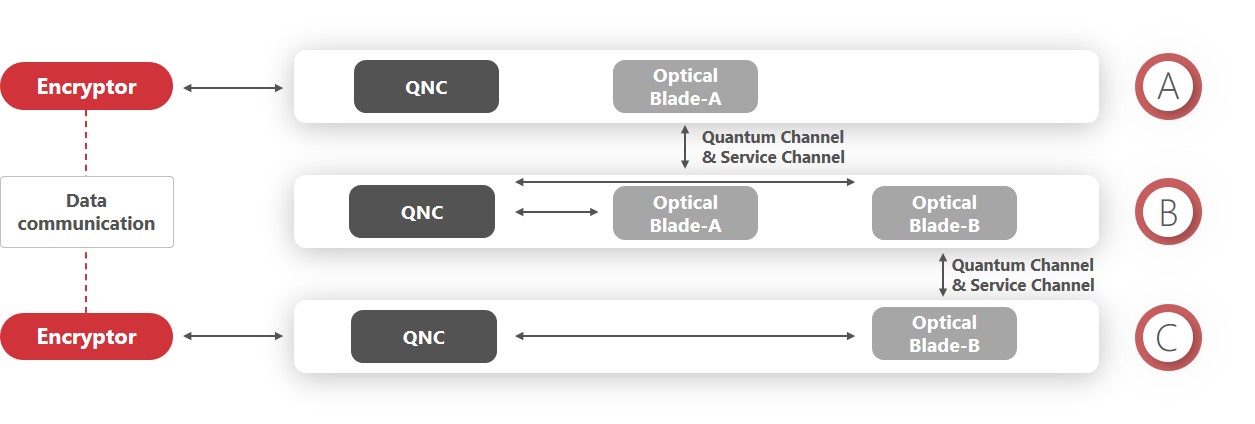

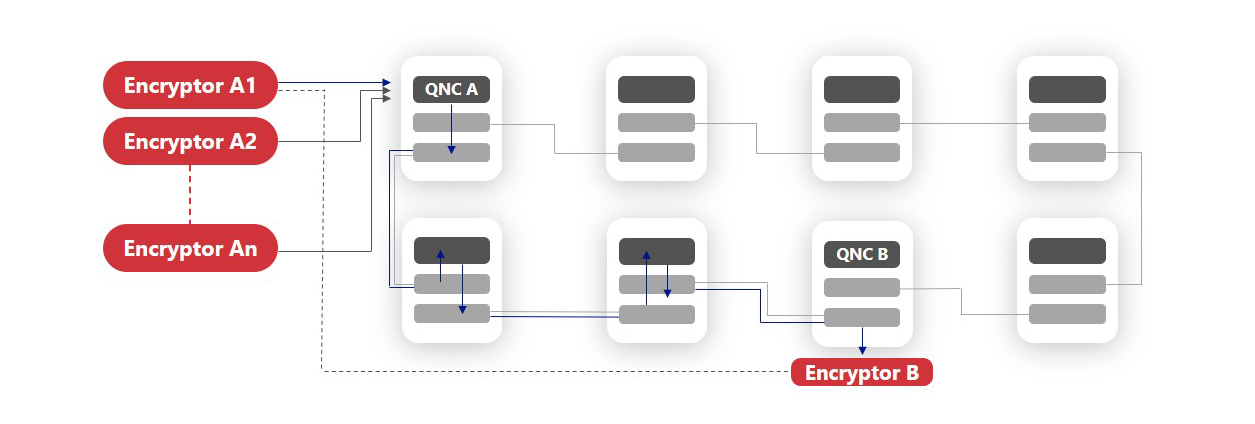

IDQ’s QKD solutions provide an additional layer of security to an existing system by providing a quantum protected channel for the key exchange.

The intrinsic properties of the single photons used to carry the key in that channel would make any interception attempt apparent to the receiver and the use of that key material would therefore be cancelled.

QKD becomes increasingly relevant in the network digitalisation process as previously distributed topologies consolidate in fewer and increasingly critical links and the adoption of SDN solutions.

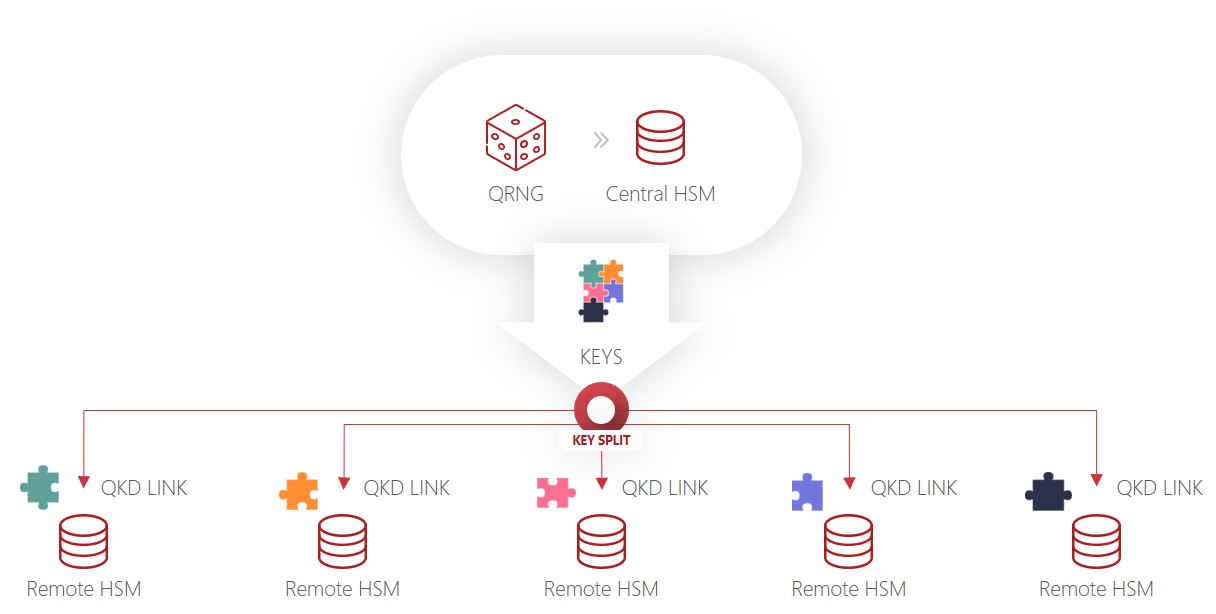

The Quantum Vault offers a tokens custody security solution that will meet the same security requirements as bank-grade security solutions on HSMs.

Why?

Main advantages: